pay indiana state taxes by mail

Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for. The best option is to pay the entire.

Indiana Retirement Tax Friendliness Smartasset

Estimated tax installment payments may be made by one of the following methods.

. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Indiana Department of Revenue. Know when I will receive my tax refund.

How Do I Pay My Indiana Property Taxes. Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States. You filed your Indiana Individual income tax return and for the first time in a long time you owe a balance.

Make a payment in-person at one of DORs district offices or. For example you can pay Indiana property. There Are Three Stages Of Collection Of Back Indiana Taxes.

How do I pay my Indiana state taxes. For a list of instructions on submitting your Indiana tax return. Depending on the amount of tax you owe.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you. The Indiana Department of Revenue and county treasury offices offer state residents more than one way to pay their taxes.

To get started click on the appropriate link. If you are owed a. Check out the who must file a tax return web page to see if youre required to file indiana state taxes.

Returns should be mailed to one of the following addresses. You do not need to be a customer to make your tax payment. Check out these steps for making a payment.

You must file a 2022 state tax return to claim the credit even if you do not normally file a tax return due to your income. Or you can pay with your return at this address. Pay by mail by sending a check payable to.

IN DOR Payments and. Depending on the amount of tax you owe you. First Merchants Bank Mooresville and Morgantown.

Find Indiana tax forms. Your browser appears to have cookies disabled. DOR Tax Forms Online access to download and print DOR tax.

Pay indiana state taxes by mail Friday June 17 2022 Edit. Cookies are required to use this site. Tax credits are not the same as tax deductions.

Make a payment online with INTIME by credit card or electronic check. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. If you are including payment.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. You may pay at the following banks. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due.

You may also pay using the electronic eCheck payment methodThis service uses a paperless check and may be used to pay the taxdue with your Indiana individual income tax. Indiana Department of Revenue. Address to mail the check to pay indiana state taxes owed.

18 States Are Sending Relief Payments To Residents Over Inflation

State Tax Deadline Extended To May 17 Wthr Com

Irs Double Bills Some Taxpayers Don T Mess With Taxes

Do I Have To File State Taxes H R Block

Clark County Indiana Treasurer S Office

9 States With No Income Tax Are They Worth It Parade Entertainment Recipes Health Life Holidays

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Free Tax Preparation Offered For Low Income Clients In Southern Indiana

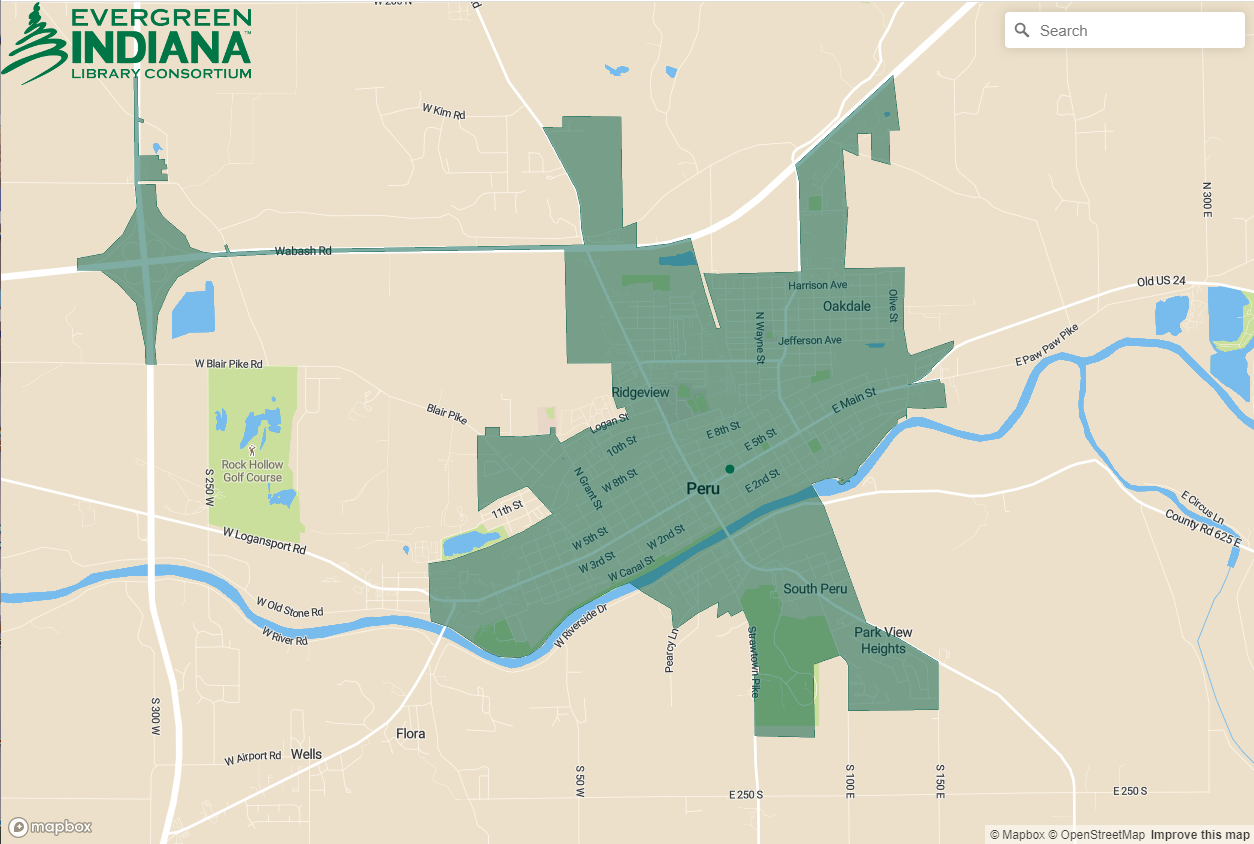

Getting A Library Card Peru Public Library

Indiana S Tax Structure Hard On Poor Families

![]()

Dor Indiana Department Of Revenue

Indiana 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Gov Holcomb Announces When Hoosiers Will Receive Tax Refund Wthr Com

State W 4 Form Detailed Withholding Forms By State Chart

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon

Indiana Delays State Tax Filing Deadline To May 17 Aligning With Federal News Indiana Public Media

Indiana Tax Refund Here S When You Can Expect To Receive Yours